OJK Unveils New Rules to Boost Regional Bond and Sukuk Issuance

JAKARTA, RAKYATNEWS – The Indonesian Financial Services Authority (OJK) has issued Regulation OJK Number 10 of 2024 concerning the Issuance and Reporting of Regional Bonds and Sukuk (POJK 10/2024) to broaden fiscal financing sources for local governments through capital market funding.

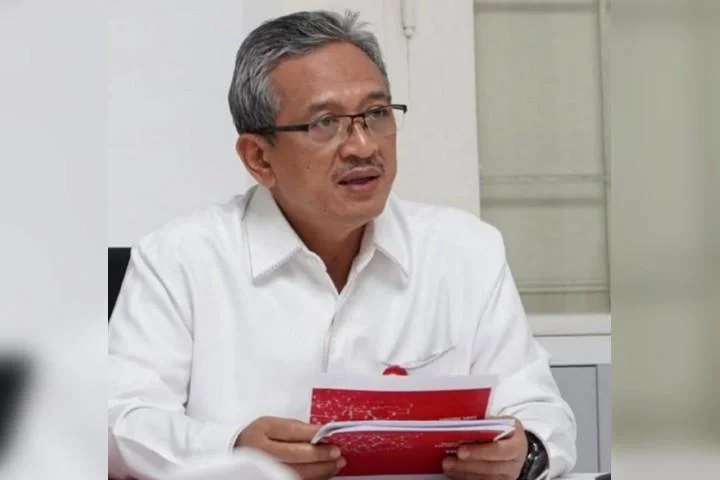

“This regulation aims to enhance transparency and oversight of regional bond and sukuk issuances,” stated Aman Santosa, Head of the Financial Literacy, Inclusion, and Communication Department at OJK, in Jakarta. (August 12)

POJK 10/2024 was introduced to align and update previous regulations governing regional bonds and sukuk, bringing them in line with Law Number 1 of 2022 on Financial Relations between Central and Regional Governments and Government Regulation Number 1 of 2024 on National Fiscal Policy Harmonization. This adjustment is intended to address issues related to the issuance of regional bonds and sukuk.

Sukuk are Islamic financial certificates, similar to bonds, that comply with Sharia (Islamic law). Instead of earning interest, which is prohibited in Islam, sukuk represent partial ownership in an asset, project, or business venture. Investors earn returns through profit-sharing or lease income derived from these assets. Sukuk are used to raise capital in a manner consistent with Islamic principles and are often utilized in both corporate and government financing.

Aman Santoso explained that POJK 10/2024 replaces and consolidates three earlier regulations issued in 2017 are POJK Number 61/POJK.04/2017 on the Registration Statement Document for Public Offering of Regional Bonds and/or Sukuk.

POJK Number 62/POJK.04/2017 on the Form and Content of the Prospectus and Summary Prospectus for Public Offering of Regional Bonds and/or Sukuk.

Tinggalkan Balasan